The new Relaunch Decree of May 13, 2020 has been published these days.

As it was immediately clear it is a revolutionary decree that brings the tax incentives to exceed the expenditure incurred reaching for the first time 110% of the construction cost. The Decree is not limited to this: instead of impiaking 10 years to recover the executed expenses we are limited to 5 years so the payback time of the investment will be very short! It is therefore a true super bonus. We have read a first draft of a set of rules that will be refined in the coming days into one or more implementing laws that will better clarify the ways of application.

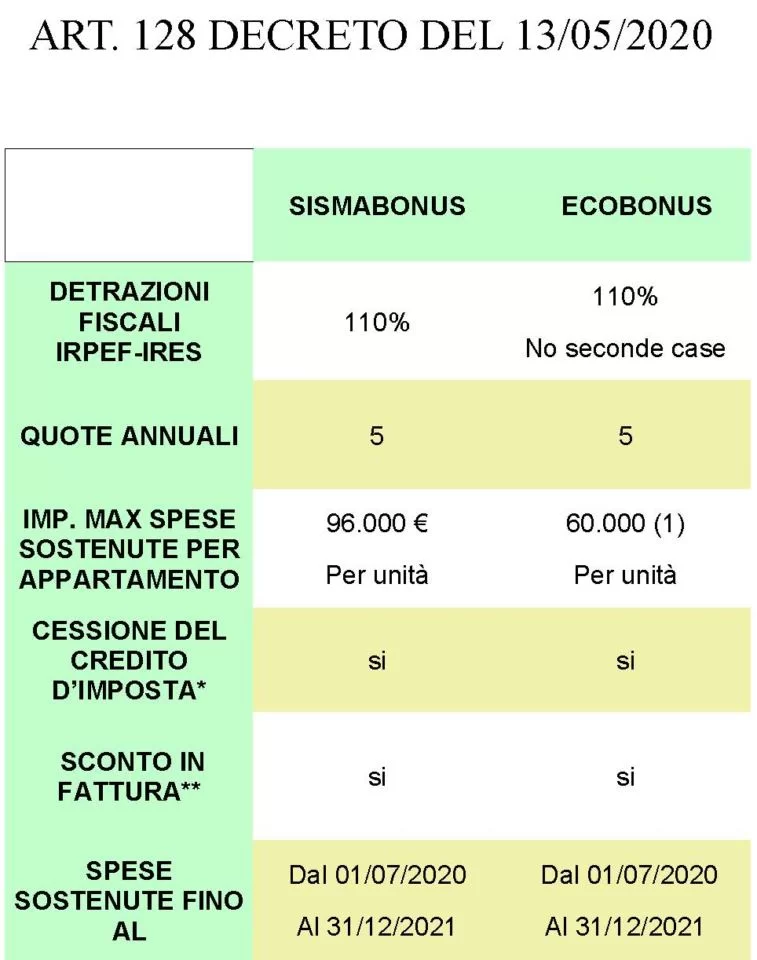

The Relaunch Decree was written in 424 pages and spans various areas of collective interest that affect care for people and economic promotion and safeguard to Italian companies, we are particularly interested in what is written in Article 128 on page 229 of the Decree. Article 128 talks about incentives to improve:

- thermal insulation up to 60,000 euros;

- Thermal systems up to 30,000;

- Seismic resistance up to 96,000 euros;

- photovoltaics up to 2,500 euros per installed Kwp;

- energy storage.

Which interventions are subject to super bonus

The government will allow people to renovate their homes by making them high-performance- reaching the levels of the wooden houses we already build-by carrying out the works with the classic building tools of:

- ordinary renovation;

- Renovation with demolition and reconstruction;

- Extraordinary maintenance of the existing;

- routine maintenance.

The works that are not subject to super bonus are those involving new volumes. For example, if a small ruin of 200 cubic meters is demolished and a passive wooden house of 300 cubic meters with an area of 100 square meters is rebuilt, the 100 cubic meter portion of the expansion will not be subject to bonus, but the bonus will apply only to the existing volume of 200 cubic meters.

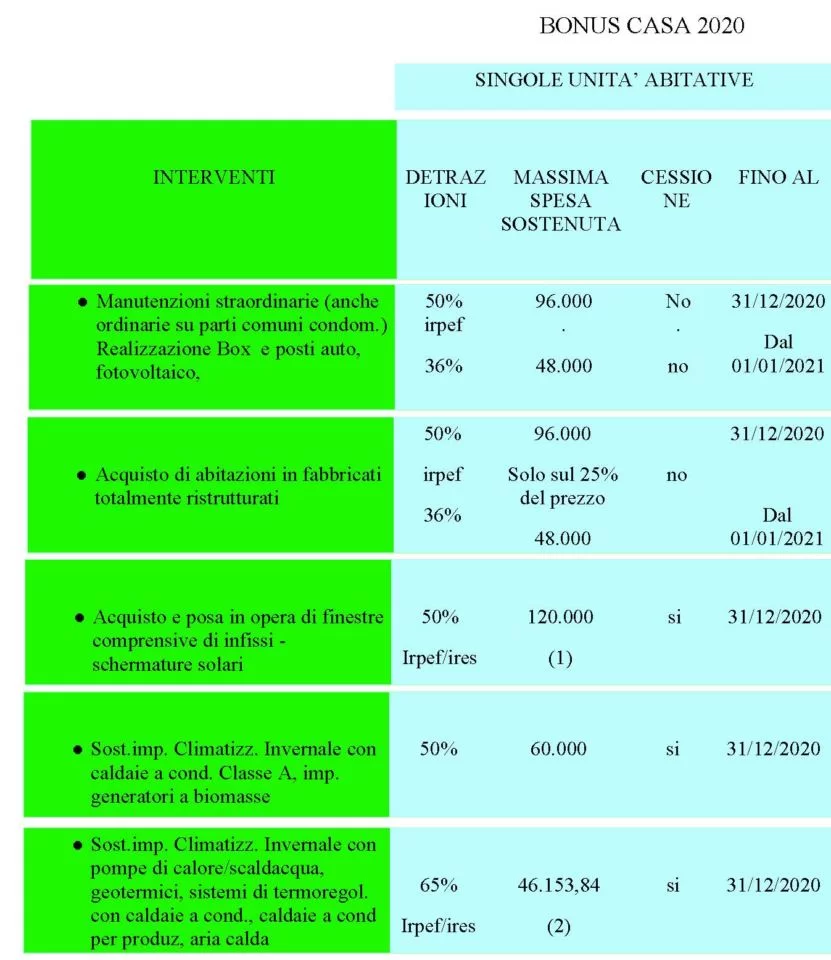

The Home Bonus 1

The super bonus replaces the pre-existing Home Bonus that will expire at the end of 2020.

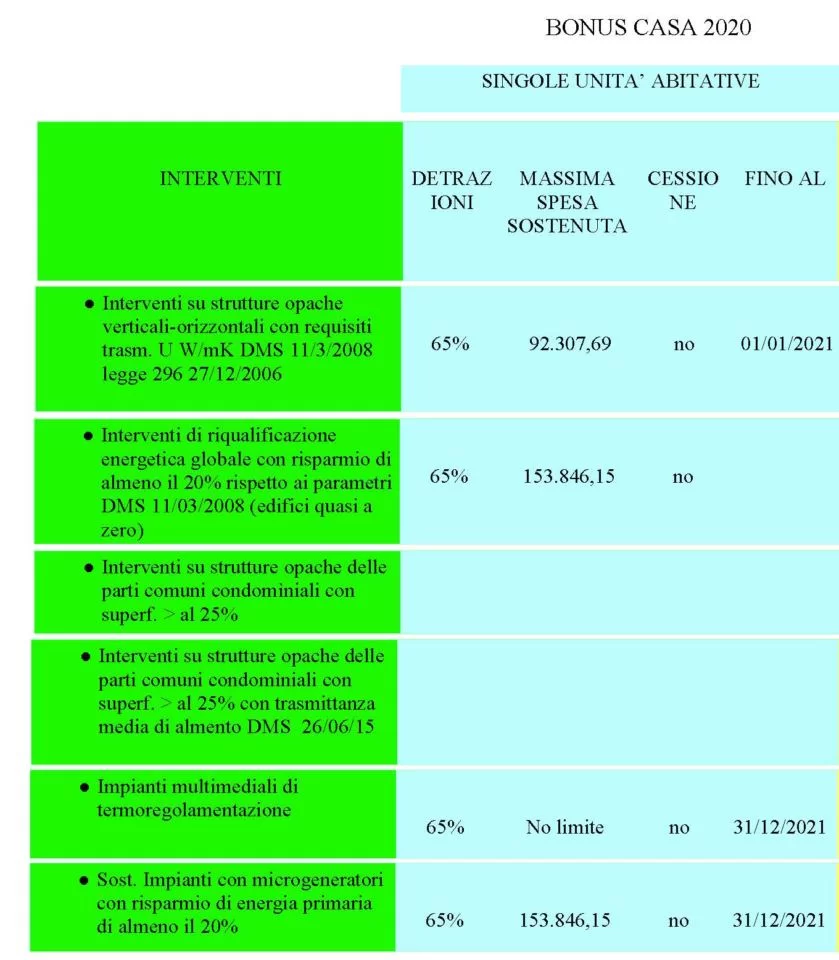

The Home Bonus 2

The super bonus of the Relaunch Decree also partially replaces the Bonus Casa 2, which had greater margins in the possibility of performing improvements on the systems and thermal insulation of buildings.

Eco Sisma Bonus

The Eco Sisma bonus was launched to enable tax recovery in facade work to improve the thermal efficiency of buildings. The purchase of household appliances, new furniture and private landscaping was also promoted on the occasion. The eco Sisma Bonus is set to expire at the end of 2020 and partly duplicates the new Relaunch Decree.

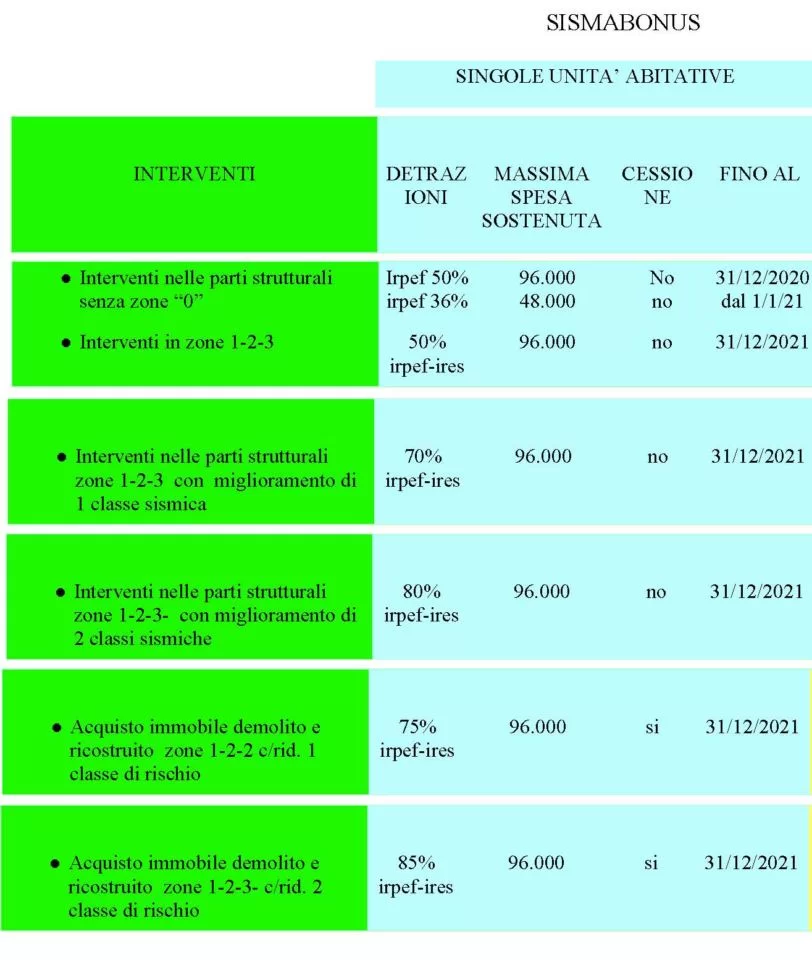

The Earthquake Bonus

The earthquake bonus was launched to allow individuals and condominiums to improve building statics by preventing the disasters that more or less every ten years strike our peninsula.

The new Relaunch Decree raises the ante on seismic improvement as well. Unfortunately, the Earthquake Bonus has not been as successful as hoped, few people have taken advantage of the Earthquake Bonus to secure their building and we will still mourn many human losses with the next earthquake that, statistically, will happen in Italy. Now the compensation comes 110% and we hope Italians will take advantage of it.

Demolition and reconstruction

Renovation theoretically means keeping existing structures. But we know that keeping existing structures is a solution often open to doubts about the real reliability of interventions. Moreover, renovating with keeping structures always means dealing with fragile stone, brick, or concrete structures that will necessarily break down in the event of a seismic event. Renovating while maintaining the original structures also often means having damp walls that are unlikely to dry out. Poorly insulated walls that are difficult to bring up to code because they themselves absorb too much heat before they are insulated. Renovating also often means running into unforeseen expenses as the human factor. lengthy workmanship etc. is highly present in the rehabilitation of existing structures. That is why we recommend, unless we are talking about historically or environmentally valuable buildings, to interpret the regulatory instrument of renovation as demolition-reconstruction. By means of demolition and reconstruction with wooden structures we can guarantee:

- Speed of execution;

- definite time and cost;

- Economy in labor on the construction site;

- maximum energy efficiency;

- guarantee of outstanding seismic resistance.

The assignment of credit

Those who lack capacity, that is, individuals who do not have a large income may not be able to take full advantage of the 110% Tax Recovery Bonus because their income does not allow for it, now have one more option that was previously reserved only for condominiums: they can sell their tax bonus to third parties. This is, again, a great opportunity to seize. It is now possible to pay only 20 percent of the construction cost of renovation work by selling the tax bonus that you fail to take advantage of to a financial institution. For more information or feasibility checks as always we remain available.