Lignodesign Excellence: A Record-breaking Energy Analysis.

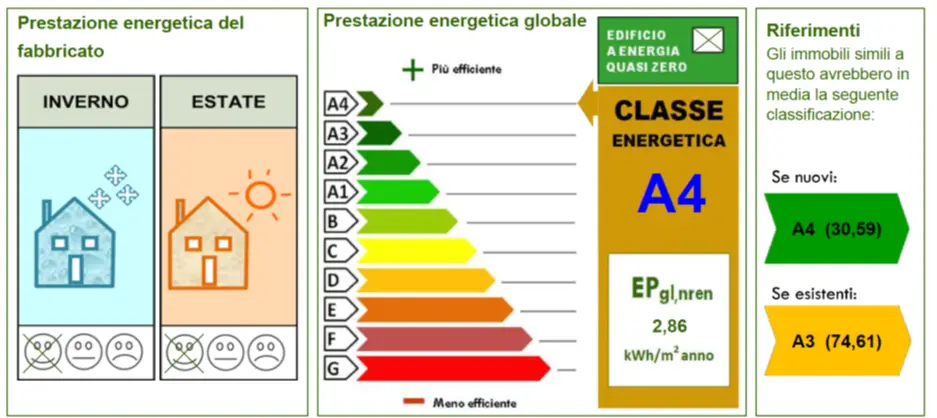

We are pleased to share the results of the record-breaking energy analysis of a Lignodesign house that we recently completed. The Energy Performance Certificate (APE) revealed an extraordinary figure: an overall non-renewable energy performance index (EPgl,nren) of just 2.86 kWh/m² per year (as visible in the image below). This value is not just a number, […]

Extension of Tax Deductions to 50% for 2026

The extension of the 50% Tax Deductions for 2026 pending formalization in the new budget law is good news for those who want to renovate their homes in an efficient and sustainable way. Much of Lignodesign ‘s activity is dedicated to seismic improvement and energy efficiency of existing buildings. That is why we welcome the […]

Energy efficiency and zero consumption goal

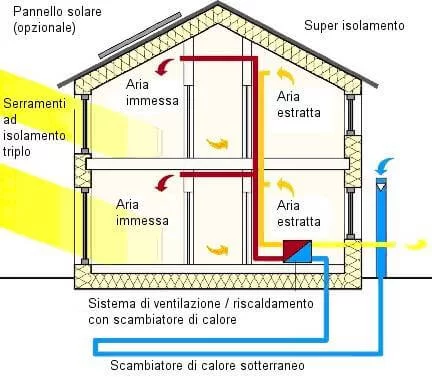

High Energy Efficient Homes: The Zero Energy Building (ZEB) Zero-consumption houses are no longer an unattainable dream, but an established building practice, as enshrined in the European Community’s 20-20-20 directive. This ambitious goal promotes energy efficiency and sustainability for all member states. To learn more, you can visit the official website: 20-20-20 Directive. An Evolution […]